Understanding the Power Brand Phenomenon

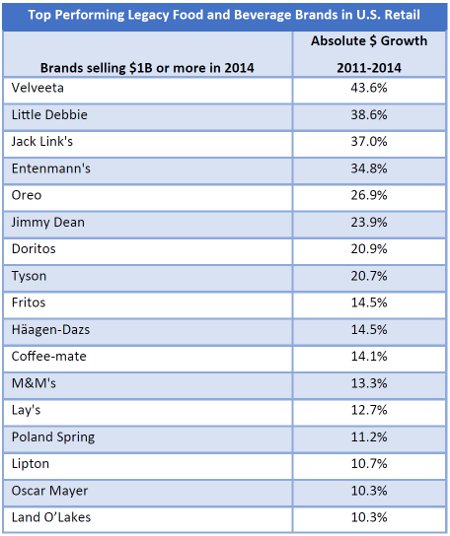

Power brands are not just cash cows. They are brands whose position in food culture and shrewd management have, together, allowed otherwise dated brands to remain contemporary and to continue to drive profit growth. Most leaders in the industry define power brands purely on the basis of scale, usually in excess of $1B in annual sales. We want to introduce to you a more future-leaning definition, one based on selecting for a proven track record of above-average market growth.

Power brands are not just cash cows. They are brands whose position in food culture and shrewd management have, together, allowed otherwise dated brands to remain contemporary and to continue to drive profit growth. Most leaders in the industry define power brands purely on the basis of scale, usually in excess of $1B in annual sales. We want to introduce to you a more future-leaning definition, one based on selecting for a proven track record of above-average market growth.

Specifically, we define power brands to mean brands that:

- had greater than $1B in sales in the past year

- had conventional channel distribution prior to 1980 (i.e., legacy brands)

- have grown faster than inflation for the past ten years (i.e., > 21 percent)

- AND have outperformed their respective sector growth rates during the past four years by at least one percent (i.e., 7.2 percent for packaged food, 6.4 percent for soft and hot beverages)

The reality is that, of roughly 213 legacy brands studied, only 8 percent can meet our strict power brand criteria. They are:

Source: Euromonitor 2015, Hartman Analysis

What is on the list:

- Mostly snack brands, including a rising star in meat snacks

- Brands sold on the fresh perimeter

- Healthy alternative beverages

- One tag-along brand (Coffee-mate) riding structural growth in a carrier category

- Highly focused brands that operate in only 1.9 operating categories on average, the majority selling in the same operating category in which they began

What is not on the list:

- Processed center-store convenience meal brands. As Americans liberate themselves from traditional notions of the meal and as snacking overtakes our eating day, many are finding that the most convenient thing to do is simply to snackify the meal. In this cultural environment, the better value proposition of fast casual restaurants is more appealing to today’s consumers’ appetites.

- Very few beverage brands. The only two that meet our criteria are those that have a noticeable orientation to contemporary notions of health and wellness due to their categories.

- Mega-brands that extended into multiple, culturally unrelated categories.

Standing back from this list, we see that long-term structural changes in: 1) how Americans eat, 2) where they shop in the store (fresh perimeter $ growth) and 3) dietary practices to achieve health and wellness goals, not just good marketing, are driving the results.

Companies that are weighted toward products not on the list need to look beyond mere renovation strategies for their base brands. Serious consideration should be given to the overall structure of their portfolios to compensate for the long-term decline or neutralization of some of their legacy brands as growth drivers. Focusing too much investment on marketing mix, turnaround solutions alone puts them at risk of underperformance.

Yet the lessons for marketers and brand stewards are equally loud and clear. Legacy brands that have become so iconic as to weather the growing trends against processed food and beverage are ones that: 1) are highly focused on one product form, one food and 2) have built an iconic brand reputation around that specific food form. Focus is not sufficient to guarantee long-term growth in a legacy brand, but it appears to be a requirement of true power brands in today’s market.

Yet the lessons for marketers and brand stewards are equally loud and clear. Legacy brands that have become so iconic as to weather the growing trends against processed food and beverage are ones that: 1) are highly focused on one product form, one food and 2) have built an iconic brand reputation around that specific food form. Focus is not sufficient to guarantee long-term growth in a legacy brand, but it appears to be a requirement of true power brands in today’s market.

For a detailed discussion of how to look for growth when your brand is not a power brand, consult our recent HB Exec issue: U.S. Packaged Foods at a Crossroads.