SodaStream Case Study: A Global Brand Loses Its Sparkle in the U.S. Market

Entering new markets is a challenging proposition for any food and beverage company contemplating global distribution. Cracking the lucrative U.S. food and beverage marketplace, while appealing to many a foreign-based brand, requires adapting market strategy to America’s complex food culture (localizing the strategy) rather than importing the old ones from the home markets or having one strategy deployed globally.

Entering new markets is a challenging proposition for any food and beverage company contemplating global distribution. Cracking the lucrative U.S. food and beverage marketplace, while appealing to many a foreign-based brand, requires adapting market strategy to America’s complex food culture (localizing the strategy) rather than importing the old ones from the home markets or having one strategy deployed globally.

The Brief

With internationally distributed food and beverage brands, we have seen a correlation between performance and how the brands are strategically positioned to acclimate to local food culture more effectively. Israeli-owned-owned SodaStream is a case study in how one company is learning the lessons of localization strategy.

Sizzle then the fizzle

SodaStream is known as the manufacturer of in-home carbonation systems. Its roots date to a 1903 patent filed in Britain but the company traveled a somewhat inglorious path until it was sold in 1998 to the Israeli-owned company, Soda-Club. Relaunched as a healthier beverage alternative, it found demand in markets across other regions, such as Western Europe (which is still the basis for the majority of the company’s revenues today).

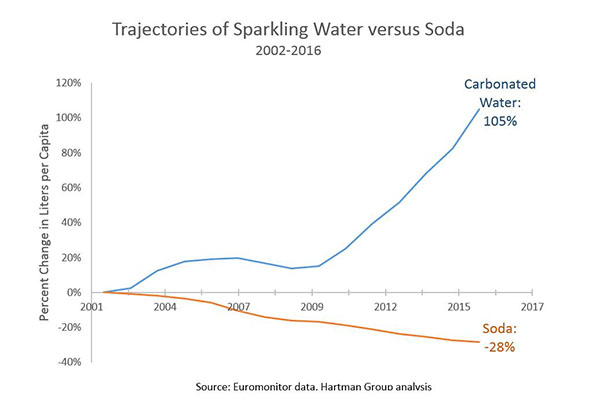

In 2010, SodaStream became publicly traded on the Nasdaq and enjoyed robust growth through 2012 in the U.S. Hartman analysis of Euromonitor data of the brand’s sales (its liquid concentrate sales, not home appliance sales) finds that SodaStream revenues peaked about that time and then began to slide. Perhaps the company failed to take into account the long-term shift in declining consumer demand for carbonated soft drinks that was playing out in American food culture.

Our analysis further finds that the business model that was employed by SodaStream in other global markets did not take hold in the U.S. market. According to Euromonitor data, $47.7M of SodaStream’s 2016 U.S. retail sales was in liquid concentrate, but the company made a total of $114.7M in revenue in the Americas. That’s 42 percent of their revenue coming from the sales of the soda aspect of the brand in the U.S. compared to 62.4 percent internationally.

The cultural picture: carbonated soft drinks vs. sparkling water

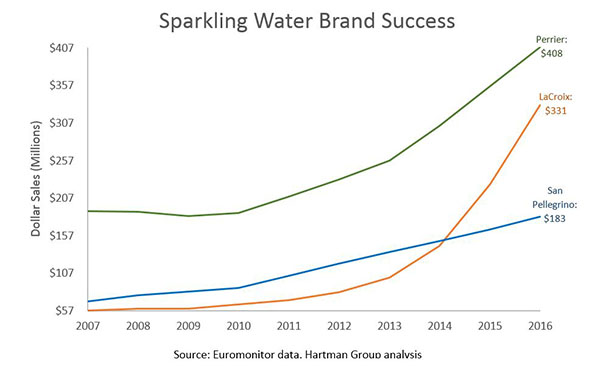

While soda has had long-term demand decline, carbonated water has been growing dramatically over the past decade. Brands that are aligned with that trend are reaping the benefits.

|

|

Rather than switching to sustainable sodas or sodas with alternative sweeteners, some consumers are avoiding carbonated soft drinks altogether. This trend is echoed in consumers’ comments from our Future of Snacking 2016 report:

“I’m a huge convert to sparkling water, and I used to trade flavors with my co-workers. But I’ve noticed my LaCroix starting to disappear from the work fridge. I try to hide my stash now!” — 32-year-old female consumer

“I dig mineral water, like Perrier or San Pellegrino, because it’s refreshing and zero calories, just like any water, but it can also be lightly flavored and has that fizzy sensation. Great substitute for sugary soda drinks.” — 28-year-old male consumer

Localization lessons

Since its 2014 sales dip, SodaStream seems to have learned that at-home carbonated water resonates better with consumers. Its own advertisements from around 2012 depicted the SodaStream’s aspiration to undercut major soda brands, which only as an aside pointed out that their soda is healthier and cuts down on plastic bottle waste. More recently, the brand messaging is more in line with health and wellness beverage trends.

With this new product positioning now lined up, SodaStream may have sales growth to look forward to as a part of a completely different brand life cycle than the one they started on in 2007. The lesson that food and beverage brand exporters should take away from this is that proper localization is a must if you want to stick your landings in new markets.

In food and beverage, cultural contexts and dynamics of consumer demands vary too widely to rely on limited localization attempts. As our social scientists and business analysts have observed, customization has been a big theme in beverages for some time now in American food culture. SodaStream fits into this do-it-yourself, in-home trend where consumers are making old-timey-style sodas that represent the movement toward higher quality—meaning seasonal, small batch, local and even organic.

Food and beverage brands that have global iconic status have an obvious advantage. These select big food companies rely on preexisting household recognition and can enter into a new market and reap sales volumes with minor or no tweaks to product design. Even these companies, however, will benefit far better with a strong localization strategy rather than employing a global standardization or export strategy.

Bending culture: creating new market opportunities

In today’s highly competitive marketplace, companies typically react to cultural change, not cause it to spread. The difference does matter. The most powerful brand-building advantage that has ever existed in consumer culture is to be a brand that drives change from the cultural margins to widespread acceptance.

The source of innovative ideas must now be the existing raw material of consumer culture and broader market forces. Localizing without a thorough understanding of the market’s food and beverage culture makes it difficult to anticipate a disconnect between your brand and consumers.

Need a cultural and market expert? Tap into the vast knowledge and analytical resources of The Hartman Group. Learn more about how our capabilities and expertise can be put to work for your brand. Contact: shelley@hartman-group.com